Checking account with a good cause

The Future checking account is no ordinary account. With this account from ING in cooperation with share, you can now easily do good. Your contribution supports social and environmental projects around the world. And if you open a new Future current account with ING by September 30, 2025, you can secure a €100 bonus!*

Your contribution

The special checking account

- Support a social or ecological project with 1 € per month

- Round up every card payment to benefit your favorite project with the optional Small Change Plus feature

- Your deposits are used sustainably by ING

Our Responsibility

Sustainability as a basis

All customer deposits on the accounts are used according to the Girokonto Future sustainability criteria. This means you support your selected funding project and the deposits are used to finance social or ecological company and project loans. You can find out more about this here .

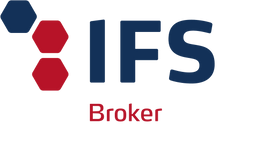

Round up please

Round-up Option

Activate the Round-up Option and automatically round up every purchase you pay for with your card. This way, you also support your funding project with every payment.

Get started now

Even more advantages

- Easy account switching

- Free VISA Card [debit card]

- Withdraw money for free – almost everywhere!

- Get started and do good!

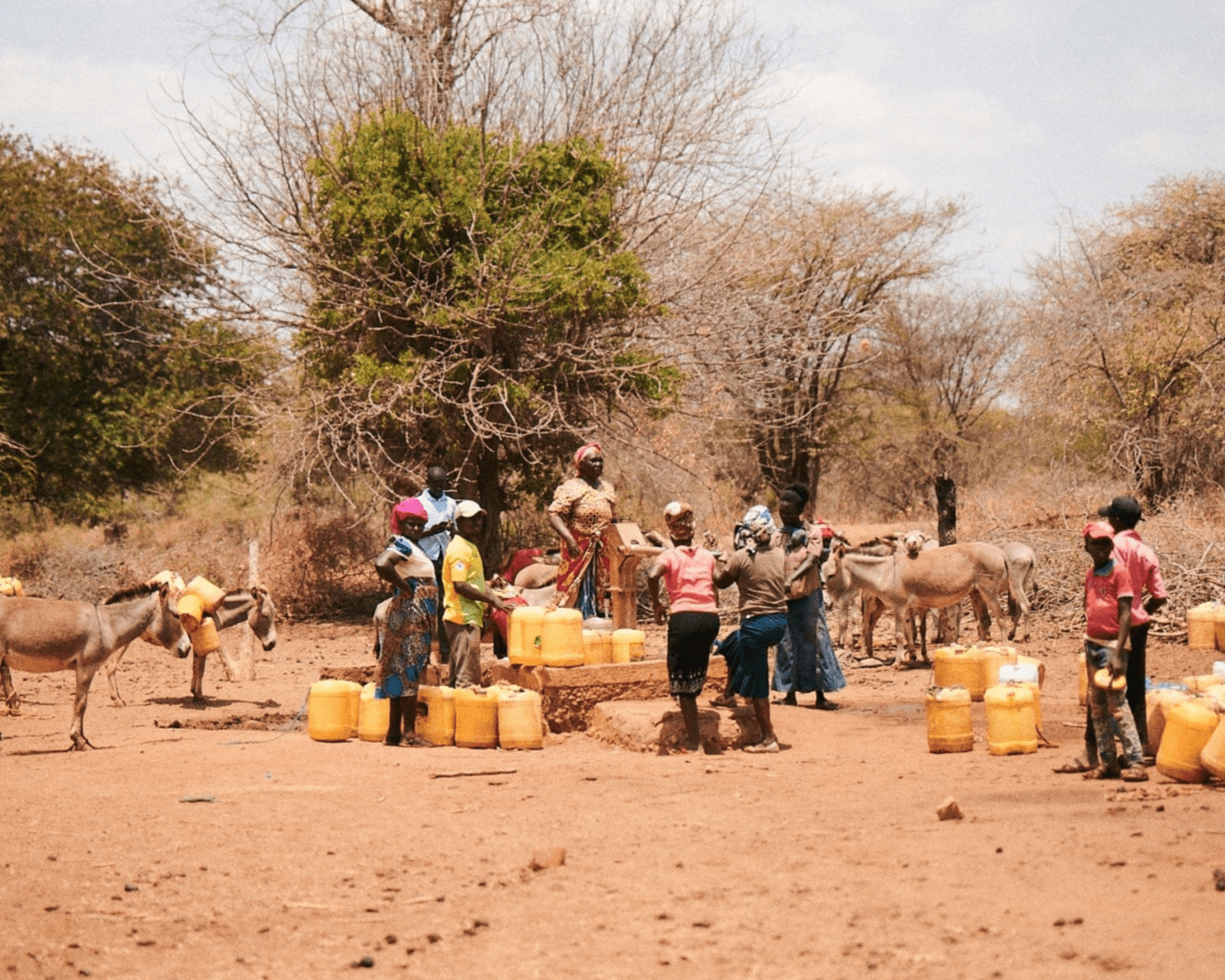

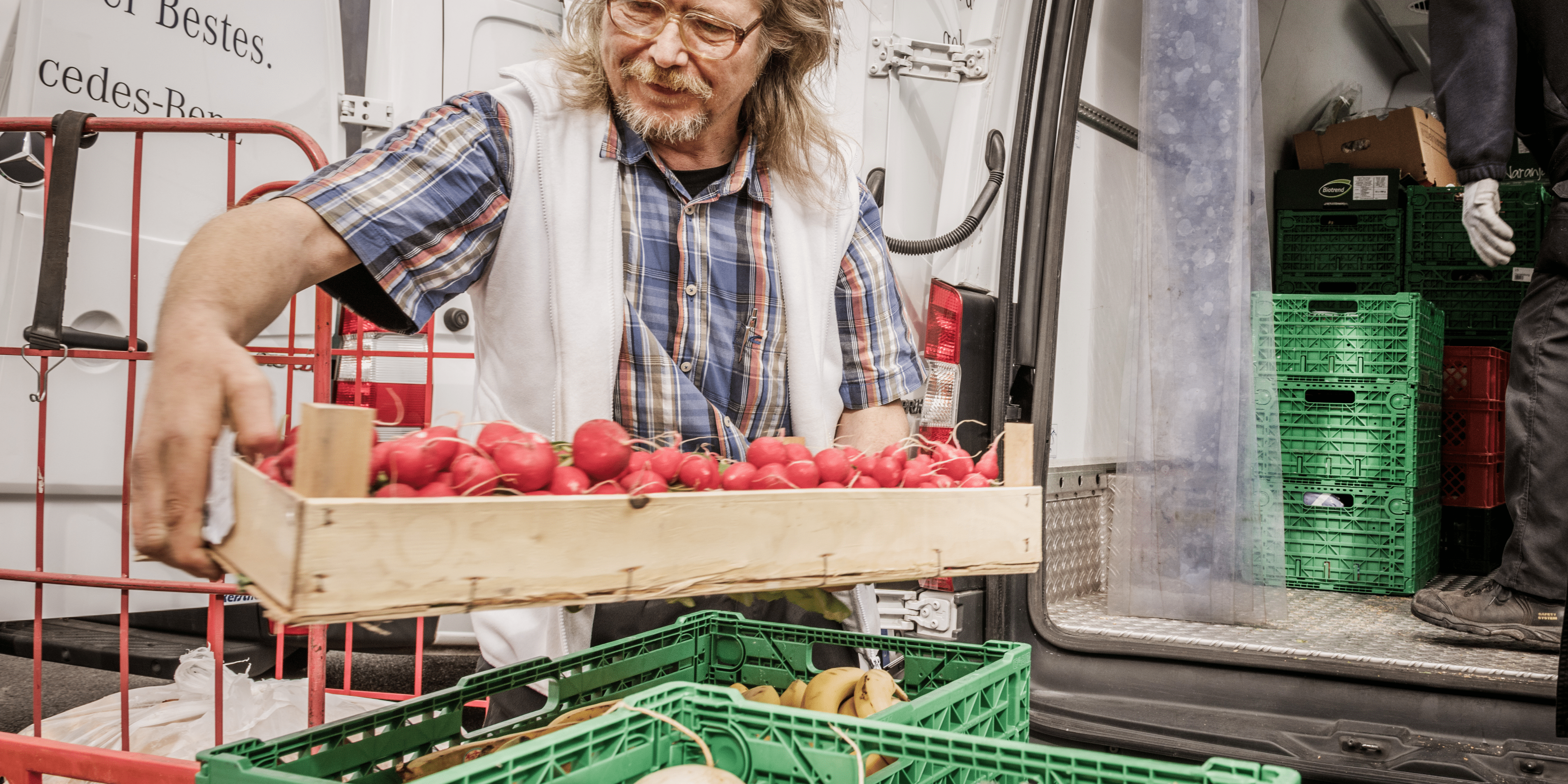

Impact project categories

All funding projects

Here you can find at a glance all the funding projects that you can support.

Everything you want to know

If you use the Future current account as your salary account (minimum monthly income of €700) or are under 28 years old, it will only cost you one euro per month. ING, as the bank, commits to donating one euro per month for each Future current account to the customer's chosen charitable project. If you do not use the account as your salary account and are over 28, an additional account maintenance fee of 4.90 euros per month will be charged. Both fees will be debited separately in the following month.

You can find all the terms and conditions for the Future current account completely transparently on the ING website.

No. You can optionally activate the Small Change Plus function. This means that purchases made with the card are rounded up to the nearest euro or 5 euros. You can also set a maximum monthly amount. 100% of this difference is forwarded to your selected funding project. So you decide for yourself whether and how much of each card payment goes to social and/or ecological projects.

ING ensures that customer deposits are used according to the Future current account sustainability criteria. Specifically, this includes financing for energy-efficient properties, social and environmental business loans, and green and social bonds.

You can read the exact sustainability criteria for the Girokonto Future account transparently on the ING website.

If you have direct questions about the Future current account , the use of deposits, or account maintenance fees, you can find information on the ING website. For questions about the funding projects, simply contact us by filling out our contact form here .